what is fit tax on paycheck

10 12 22 24 32 35 and 37. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare.

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

That 13 is your effective tax rate.

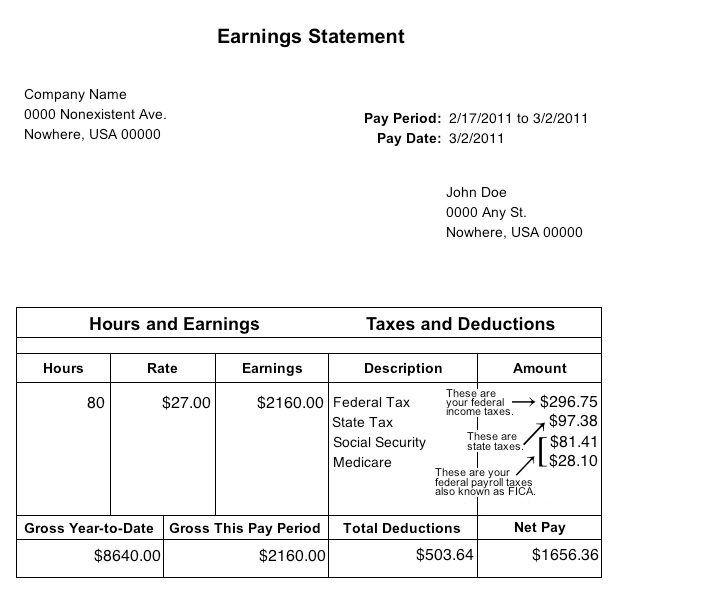

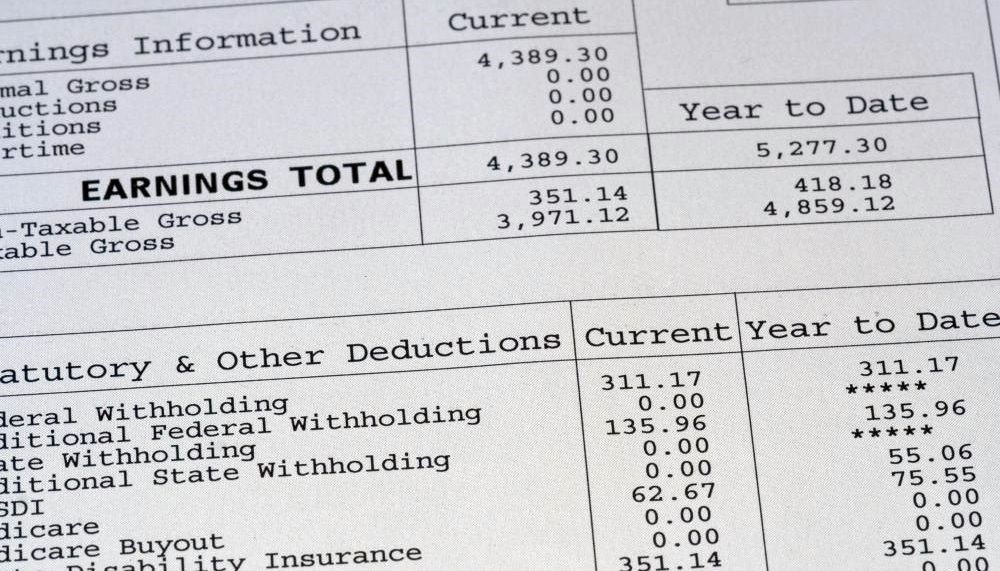

. The federal income tax is a pay-as-you-go tax. The FIT deduction on your paycheck represents the federal tax. A pay stub is a segment of your paycheck except that it carries the details of tax deductions and the employees net pay earned for a particular working period.

If your total bonuses are higher than 1 million the first 1 million gets taxed at 22 and every dollar over that gets taxed at 37. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

Federal income tax and FICA tax. What is income tax in simple words. You have nonresident alien status.

What percentage is fit tax. The federal withholding tax has seven rates for 2021. The federal withholding tax rate an employee owes depends on their income.

The top marginal income tax rate. The amount of income you earn. FIT taxes are the income taxes that you pay to the federal government.

Its important to remember that moving up into a higher tax bracket does not mean that all of your income will. Estimate your tax withholding with the new Form W-4P. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens.

Our online Monthly tax calculator will automatically work out all your deductions. Is fit the same as federal withholding. It depends on.

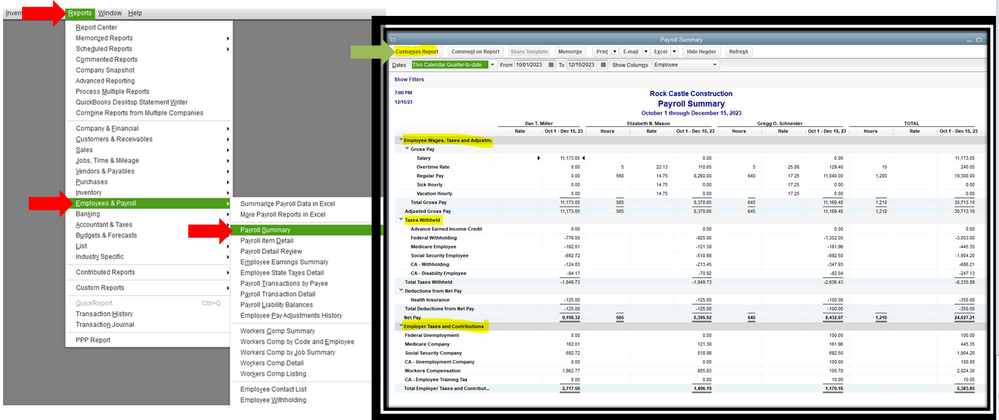

Your employer uses the data in your IRS filing sheet to determine how much of your pay to withhold. FIT tax is calculated based on an employees Form W-4. Currently has seven federal income tax brackets with rates of 10 12 22 24 32 35 and 37.

Thats the deal only for federal income. 10 12 22 24 32 35 and 37. The federal income tax has seven tax rates for 2020.

How Your Paycheck Works. For 2020 there are seven income tax brackets. The amount of federal income tax.

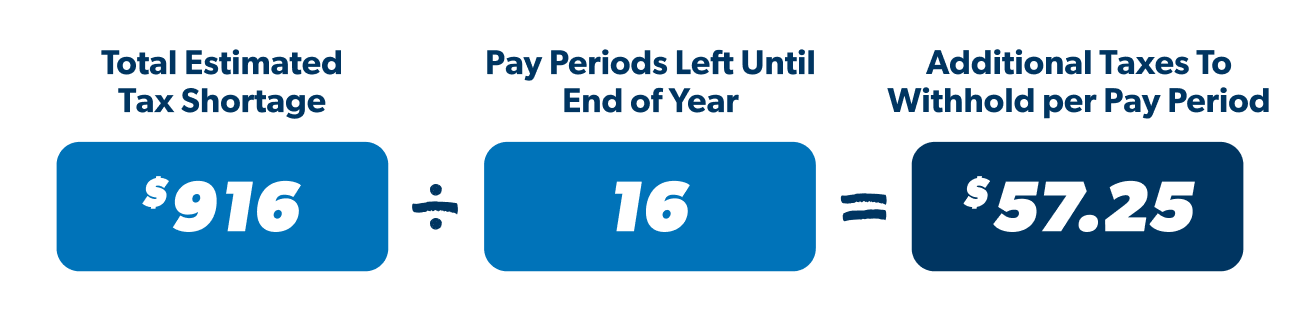

Income Tax is a tax you pay directly to the government basis your income or profit. Your income tax rate is dependent on the amount of taxable income you earn because federal income tax is built on a progressive tax system. Taxpayers can avoid a surprise at tax time by checking their.

Income tax is collected by the Government of India. How much is FIT tax. For employees withholding is the amount of federal income tax withheld from your paycheck.

Your employer must use the percentage. Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate. Taxpayers pay the tax as they earn or receive income during the year.

The total bill would be about 6600 about 13 of your taxable income even though youre in the 22 bracket. If youre one of the lucky few to. Employers withhold FIT using either a percentage method bracket method or alternative.

With this information you can prepare for tax season. The tax rates for 2020 are. Fit is the amount required by law for employers to withhold from wages to pay taxes.

The amount of income tax your employer withholds from your regular pay depends. There are seven federal income tax rates in 2022. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible.

Federal income tax FIT is withheld from employee earnings each payroll.

![]()

How To Calculate Payroll Taxes Step By Step Instructions Onpay

Payroll Tax Rates 2022 Guide Forbes Advisor

Understanding Your Paycheck Taxes Withholdings More Supermoney

Solved Federal Taxes Not Deducted Correctly

What Are Employer Taxes And Employee Taxes Gusto

3 03 Calculating Box Totals On Form W 2 Office Of The University Controller

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

:max_bytes(150000):strip_icc()/what-is-a-pay-period-what-are-types-of-pay-periods-398392-19e52064e0e9480da20d294432b7c2ac.png)

How Are Pay Periods Determined

Types Of Taxes The 3 Basic Tax Types Tax Foundation

How To Calculate Your Tax Withholding Ramsey

Taxable Wage Definition For Social Security Taxes

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

How To Read A Pay Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

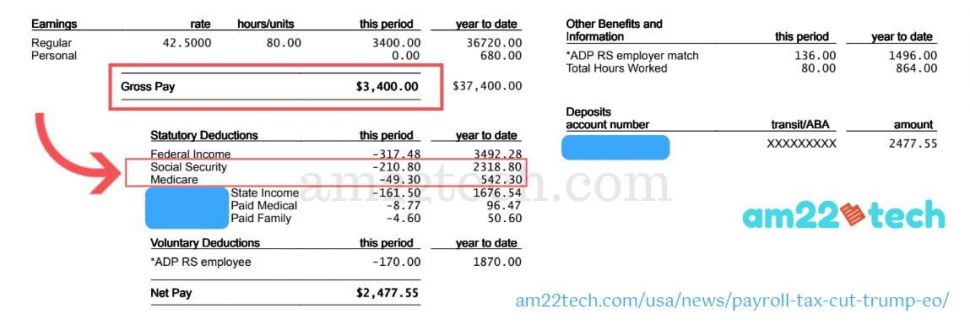

Payroll Tax Cut Trump Order Should H1b L1 Use It Am22tech

Paycheck Calculator W 4 Help Paycheck Details Form W 2

How To Calculate Federal Income Tax

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities